Best Alternatives to Square & PayPal Here: Accept Credit Card Payments On the Go

Intro

The most convenient thing about smartphones where retailers and sellers are concerned is the ability to accept payments — even if it’s a credit card swipe. With just a small gadget (the card reader) and your smartphone, you have a mobile POS that’s as good as any.

Square Inc. introduced what turned out into one of the most revolutionary things that have happened to mobile POS and credit card payment processing. Naturally, they’re still one of the leaders when it comes to processing payments on-the-go.

But they aren’t alone. There’s PayPal Here (for starters) and many other apps from both industry-veterans (in payment processing) and new startups trying to get a slice of the payments market.

So we went after the alternatives to Square and PayPal Here. If you’re one of those who’s looking for a cheaper or better or simpler or feature-rich alternative to these credit card payment apps, here’s all.

The Three Types

I’ve segmented these credit card payment apps into three sections to make it easy for you to figure out which ones you’ll want to test.

- Apps from industry-veterans like Intuit

- Decent to good alternatives that you may/may not have heard of

- New apps that you should experiment with

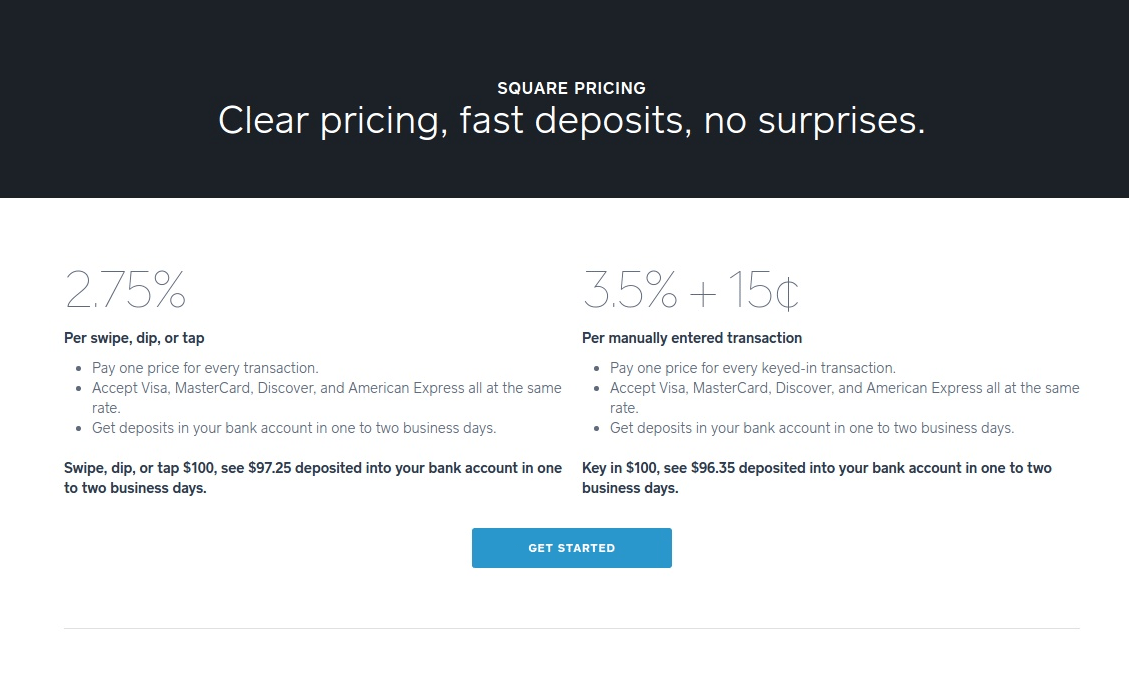

Benchmark: Square

Square charges a per-transaction fee (and everyone else does the same). We’ll set this as the benchmark to compare other apps and servies.

When you use Square, you pay 2.75% of every swiped transaction (using the card reader) and 3.5% + $0.15 per keyed-in transaction (where you manually enter the credit card details). There are no other monthly charges or fees.

Apps from Industry-veterans

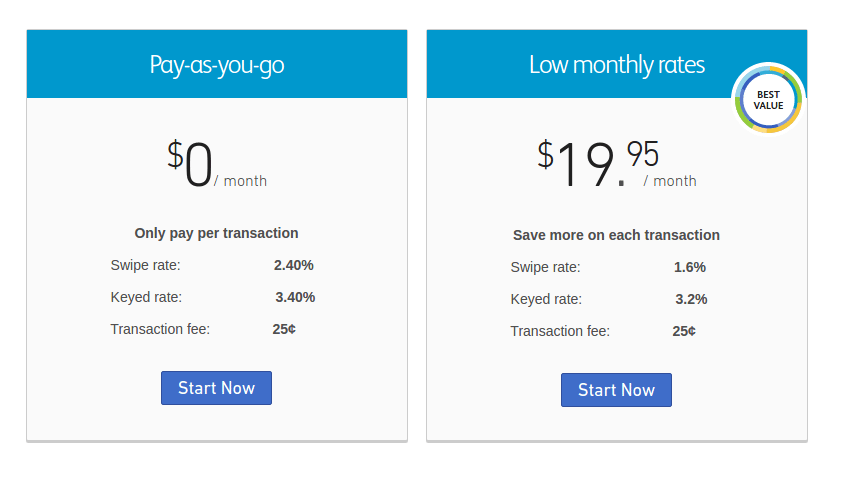

Intuit GoPayment

Intuit / QuickBooks needs no introduction. They are the go-to payments processing and management company that hundreds of thousands of companies rely on.

The QuickBooks GoPayment app is very similar to Square in the way it works. The one big advantage here is that QuickBooks is also a big player in merchant accounts and account management so when you use the QuickBooks Go, you get the benefit of syncing it with your QuickBooks account.

QuickBooks has two plans. One doesn’t involve any monthly commitment and charges you 2.7% per transaction. The other plan costs you $19.95 and you pay 1.6% plus $.25 per transaction. The math says that the Intuit GoPayment starts to be cheaper than Square if you’re doing more than $3000 a month with not more than 70-80 transactions in that month.

Spark Pay

Spark Pay from Capital One is an all-out ecommerce system. These guys produce cloud software for small businesses to setup their shops and process payments.

The Spark Pay “Sell In Person” featurette is a subset of their offering (but you can just get the “hardware” and start accepting credit card payments). Once you register for a free account at Spark Pay, you get the free Mobile Reader.

There are two plans. The Pro Plan and the Go Plan.

Go Plan works just like Square. No monthly charges or commitment. Pay as you go for every transaction. The rate is 2.65% plus $0.05 per swipe. Keyed-in transactions are 3.7% plus the $0.05 fee. That’s a tad costlier than Square.

The Pro Plan will cost you $19 per month for reduced swipe and key-in rates. Every swipe will cost you 1.99% plus the $0.05 fee. A key-in transaction will cost you 2.8% plus $0.05.

If you process payments to the tune of $3500 or more, you’ll notice that Spark Pay’s Pro Plan is cheaper than Square.

Good ones

Clover Go

Clover, I just realized, is an entire suite for merchant account systems. It’s for the serious businesses with a lot of turnover every year. If you’re a small indie business, CloverGo might sound like an overkill unless you need a merchant account that does all your finances for you.

Clover Go is sold by banks like the Bank of America. Yes, “sold”. I’ve read that the Clover Go readers can cost between $30 and $100 for the device depending on who you buy it from along with what other products you buy.

Clover Go’s charges are straightforward. 2.7% per transaction with no other charges. But, for keyed-in transactions, that goes to 3.5% plus a $0.15 per transaction.

The reason Clover Go reader costs that much is because it is both chip/pin and magstripe compatible and works with all credit and debit cards.

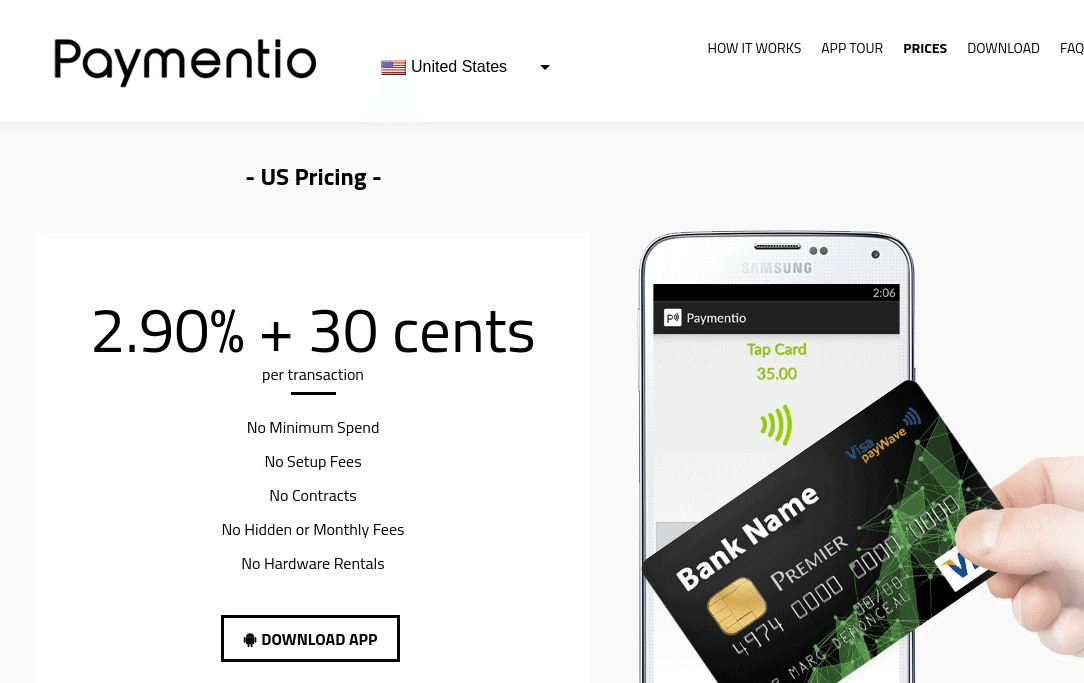

Paymentio.com

To be honest, Paymentio shouldn’t be featured as a Square alternative given the fact that there’s no “swipe” feature here. Paymentio works on NFC (compliant to the terms) and to use Paymentio, you’ll need an NFC-capable smartphone.

Somewhat oddly, Paymentio charges a little more than Square does.

For every transaction, Paymentio takes a 2.9% cut along with a $0.30 charge per transaction. For $100, that’s $3.20.

But here’s the kicker that makes Paymentio a viable option. The NFC tap works for Visa payWave and MasterCard PayPass only. For other cards, you need to manually enter the details. But there’s no extra charge or different pricing for it. This means, even if you key-in, you pay only $3.2 per $100 unlike Square’s $3.65.

EMS+

EMS+ is from Electronic Merchant Systems and is possibly the only place you can get to choose a color for your free card reader (from of course a limited set of color options).

Like Square, EMS+ is simple to use. Just get the free card reader, install the app and you’re good to go. You have no monthly fees or commitments here.

EMS+ is cheaper than Square for all the swipe transactions by a considerable factor. If Square’s at 2.75%, EMS+ will only take a 2.25% cut out of every swipe transaction. For keyed-in transactions, EMS+ charges the same as Square, 3.5% plus $0.15 per transaction.

Experimental

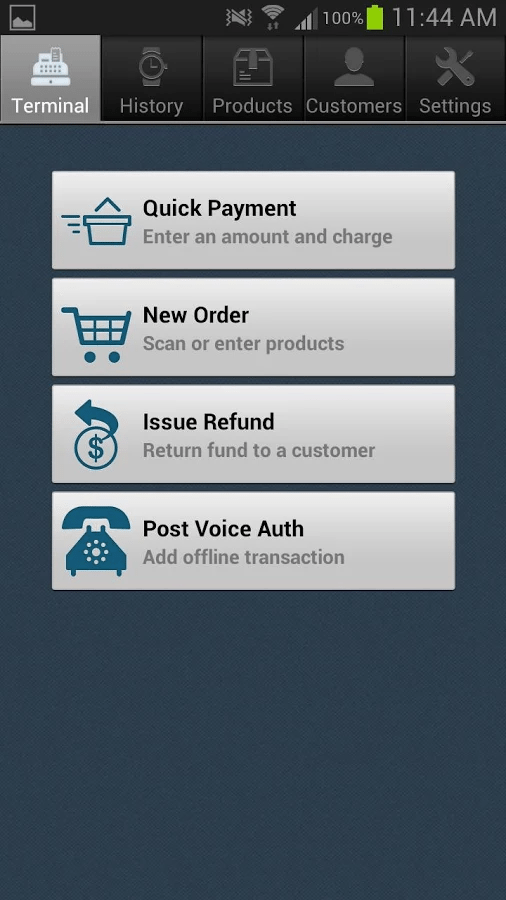

Handpoint

If you’re in the UK/Iceland, you might have heard of Handpoint. It’s touted as one of the first PCI P2PE certified mPOS app in the world.

Handpoint charges a flat 2.65% per transaction and there’s no known extra charge (like per-transaction cents that payment systems apply). According to the information on the website, this is all you pay when you transact using Handpoint’s reader and app. Incidentally, Handpoint has been in the POS-industry for over a decade with some popular POS hardware.

The only glitch in the matrix that I see is Handpoint charges you £99 for the reader. The reader is of course special like the one being sold by Clover Go. It can accept chip/pin as well as magstripe cards (so perhaps that’s why it costs you money while every other reader is free). At just 2.65% per transaction, it’s slightly more cost-effective than Square.

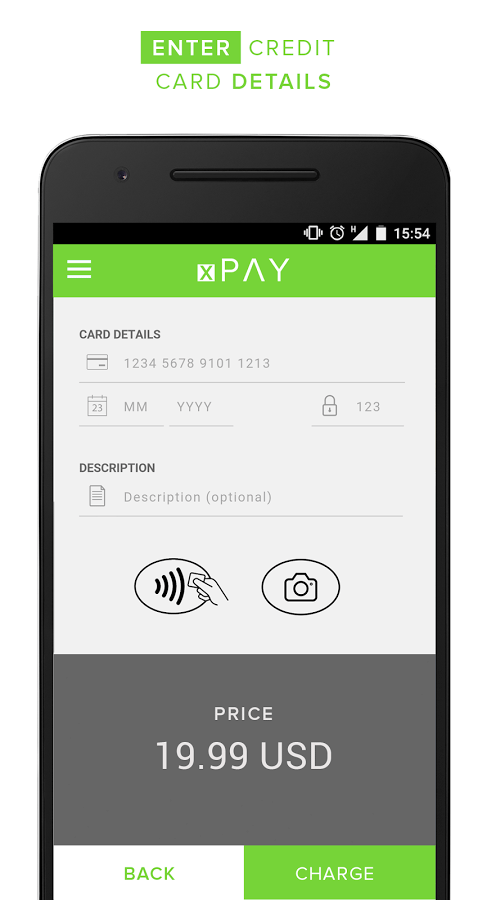

xPAY

If you’re a fan of minimalist apps (like me), xPAY is an app you should check out for a lot of reasons.

But just to be clear, this app is not based on card-reader addons. You can either key-in the credit card details or if your device is NFC-capable, scan the card details into the app. All payments are processed through Stripe so if your country is out of the loop (no Stripe support), you can’t use this app.

What caught my attention to this was the pricing model. There are no monthly fees but the standard charge per transaction is 1.5% plus a $0.30. I did the math. It’s the cheapest payment processor in town (or at least on this list).

Closing Thoughts

While Square’s a very good app to get you started, if you’re processing payments in large volumes, you should definitely go for the monthly plans offered by other companies (or pick up simpler apps with cheaper rates per transaction).

1 Comment

[…] People in the know acknowledge that Square has become the benchmark for small businesses needing a device to read credit cards via smartphone and easily accept payments. But the company is not without competition. From giants like PayPal (NASDAQ:PYPL) and Intuit (NASDAQ:INTU), to still-privately owned Stripe, Square faces a whole host of rivals now offering their own devices. […]